Back office account activity

View your Account activity!

Staying on top of your finances is easier with a real-time view of your account activity. This guide shows you how to monitor your transactions as they happen. While the dashboard is always updating, it can take a minute or two for newly processed transactions to appear.

You can also view your deposits on this dashboard. Deposits are scheduled to arrive in your bank account within two business days.

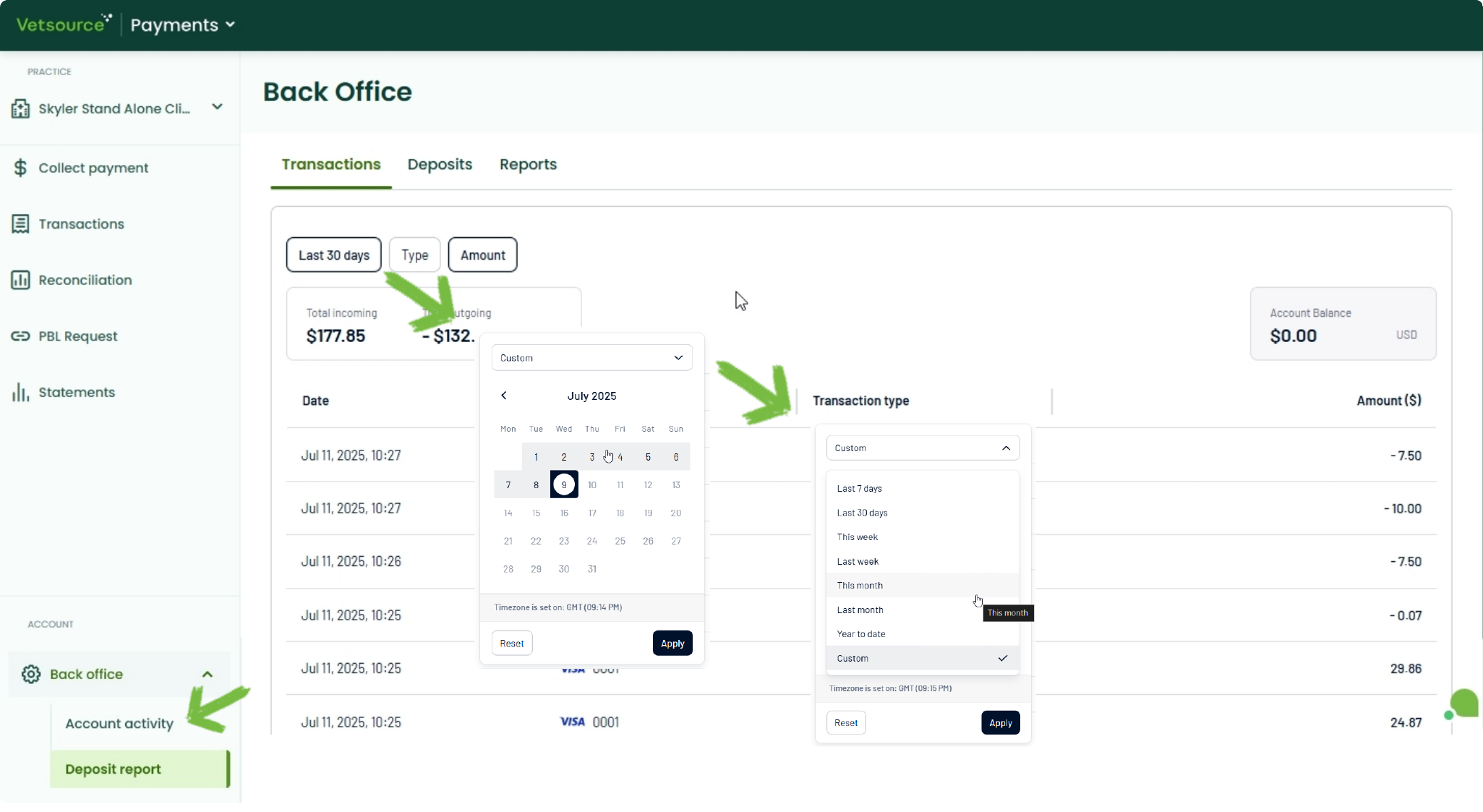

Use the date filter on any tab to quickly pinpoint the exact information you're looking for.

Transactions

Find the full details for your transactions on the Transactions tab. The page conveniently displays only those transaction details that match your Date, Type, and Amount filters. You'll also see helpful Total incoming and Total outgoing widgets, based on the filters you've applied, to give you a quick overview of your finances.

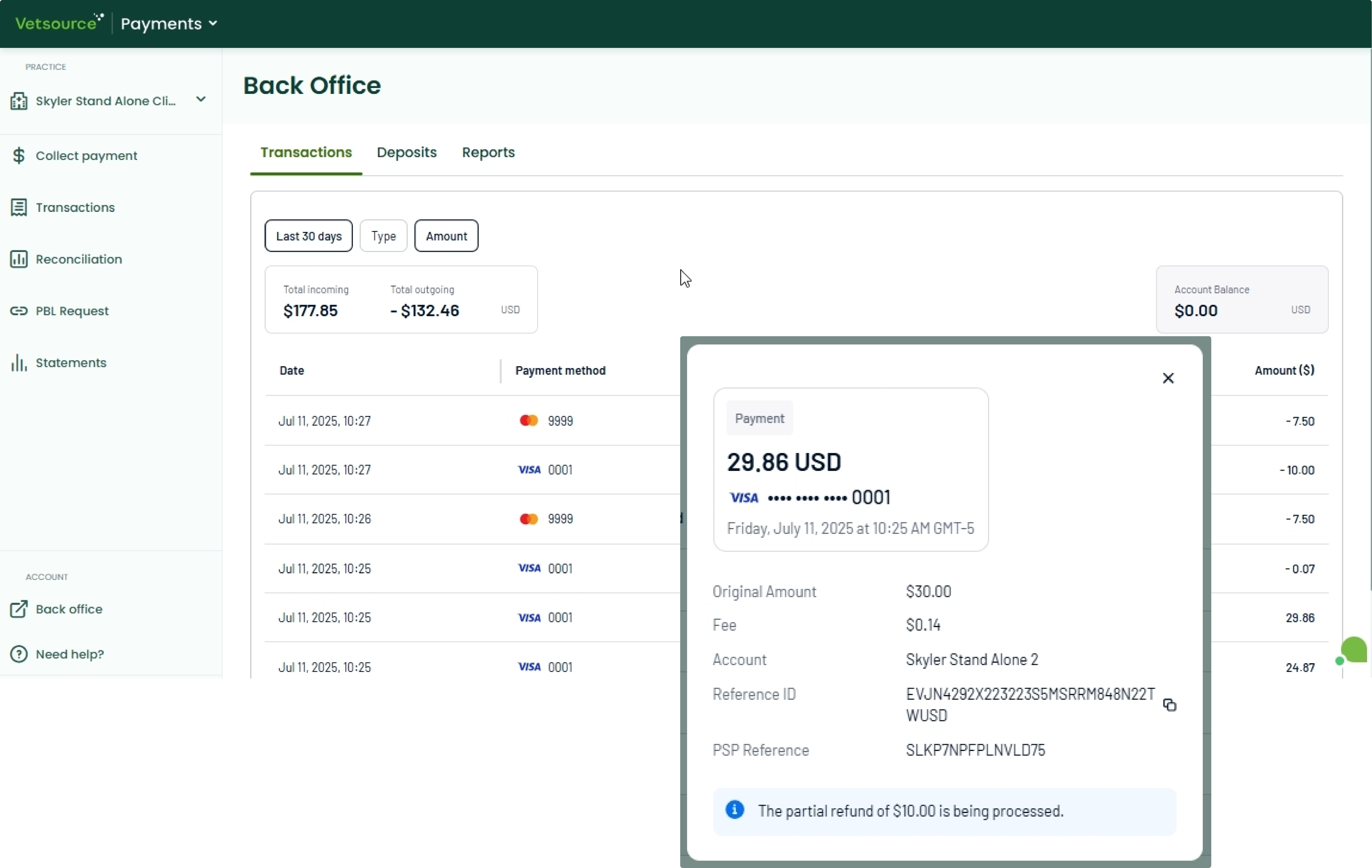

Click on any individual transaction to display a pop-up with all the key information you need:

- Original Amount: The exact amount your client paid.

- Fee: Vetsource deducts its fees directly from your payment. Any additional card brand fees will appear as separate transactions on this list, but all related transactions will share the same PSP Reference.

- PSP Reference: This is your payment reference number, essential when contacting our support team and reconciling your reports.

- Card details including the type of card used (e.g., Visa, Mastercard) and the last four digits of the card.

- The date and time the transaction occurred.

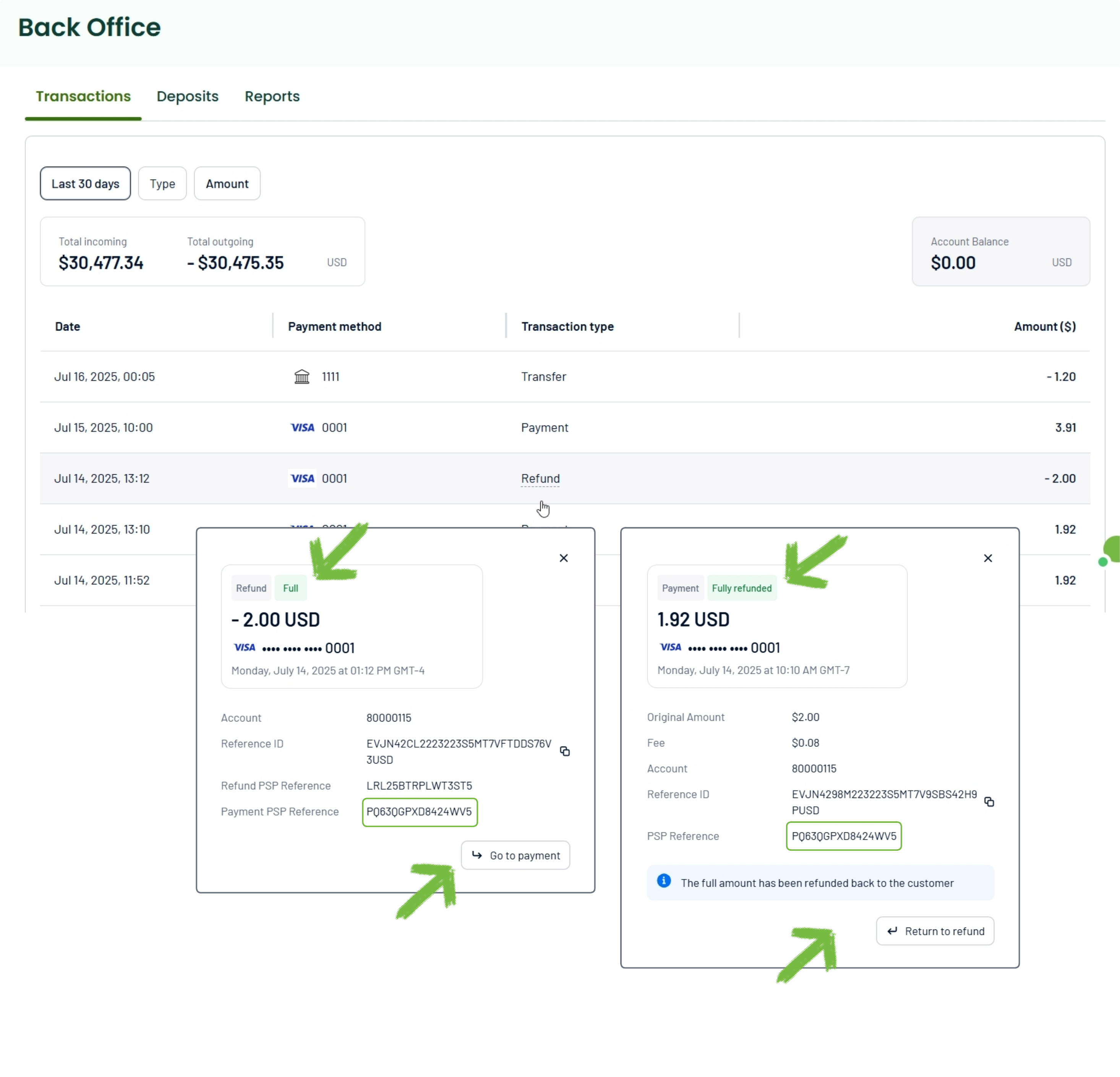

Refunds

Easily spot if a refund has been applied within the original payment's transaction details. While the refund transaction will appear separately, you'll find a convenient button within the refund details to jump right back to the original payment. This design ensures all payments, refunds, and fees for a single transaction consistently share the same PSP Reference, making tracking seamless.

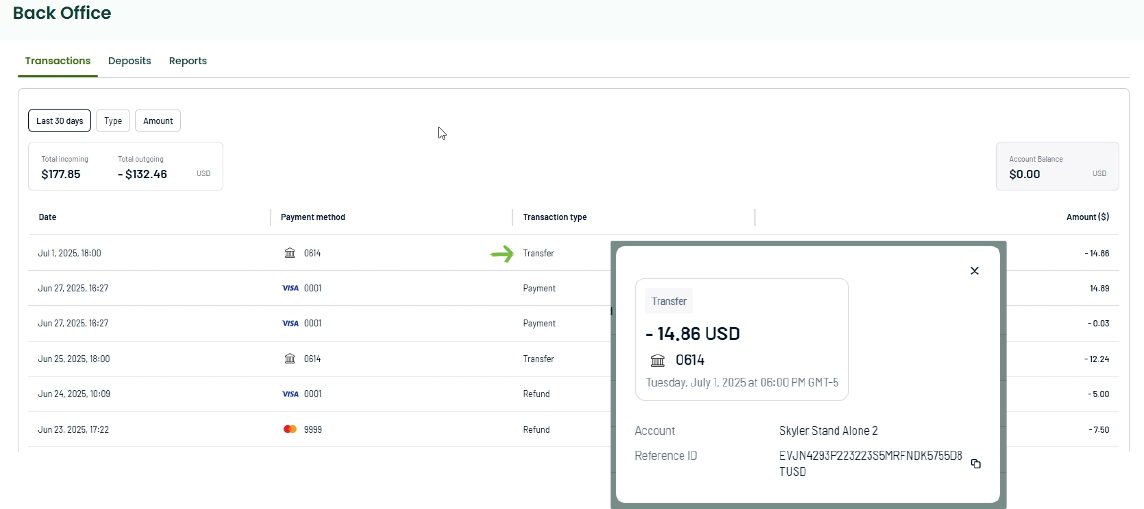

Transfers

As your payment facilitator, Vetsource handles all money movement related to your account. This means any transfer you see represents the flow of funds managed by us—whether it's receiving customer payments, deducting fees, or sending money to your own bank account.

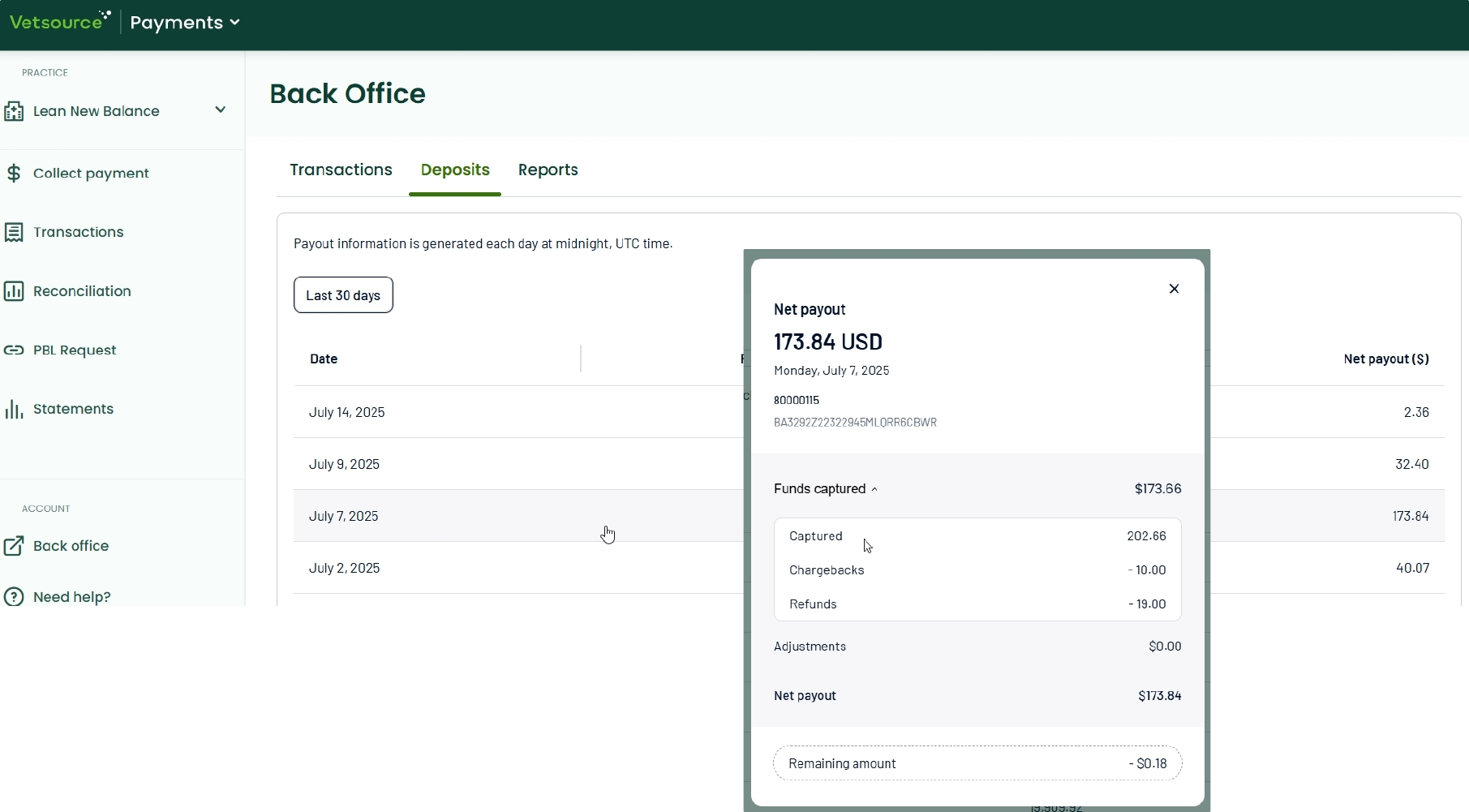

Deposits

View your daily deposits by navigating to the Deposits tab. Select a deposit for more details.

In the Funds Captured drop-down, you'll see a breakdown of your money, helping you understand what you've earned and what's pending.

- Captured: This is the money left over from what customers paid, after all the fees are taken out.

- Refunds: Money you've returned to customers.

- Chargebacks: This happens when a customer disputes a payment with their bank, and the money is then taken back from you.

Adjustments: This covers manual changes to your balance that aren't directly related to customer payments.

Net Payout: This is your total bank deposit—the actual amount of money transferred to your account.

Remaining Amount: This shows any funds that are still pending or waiting to be deposited into your account.

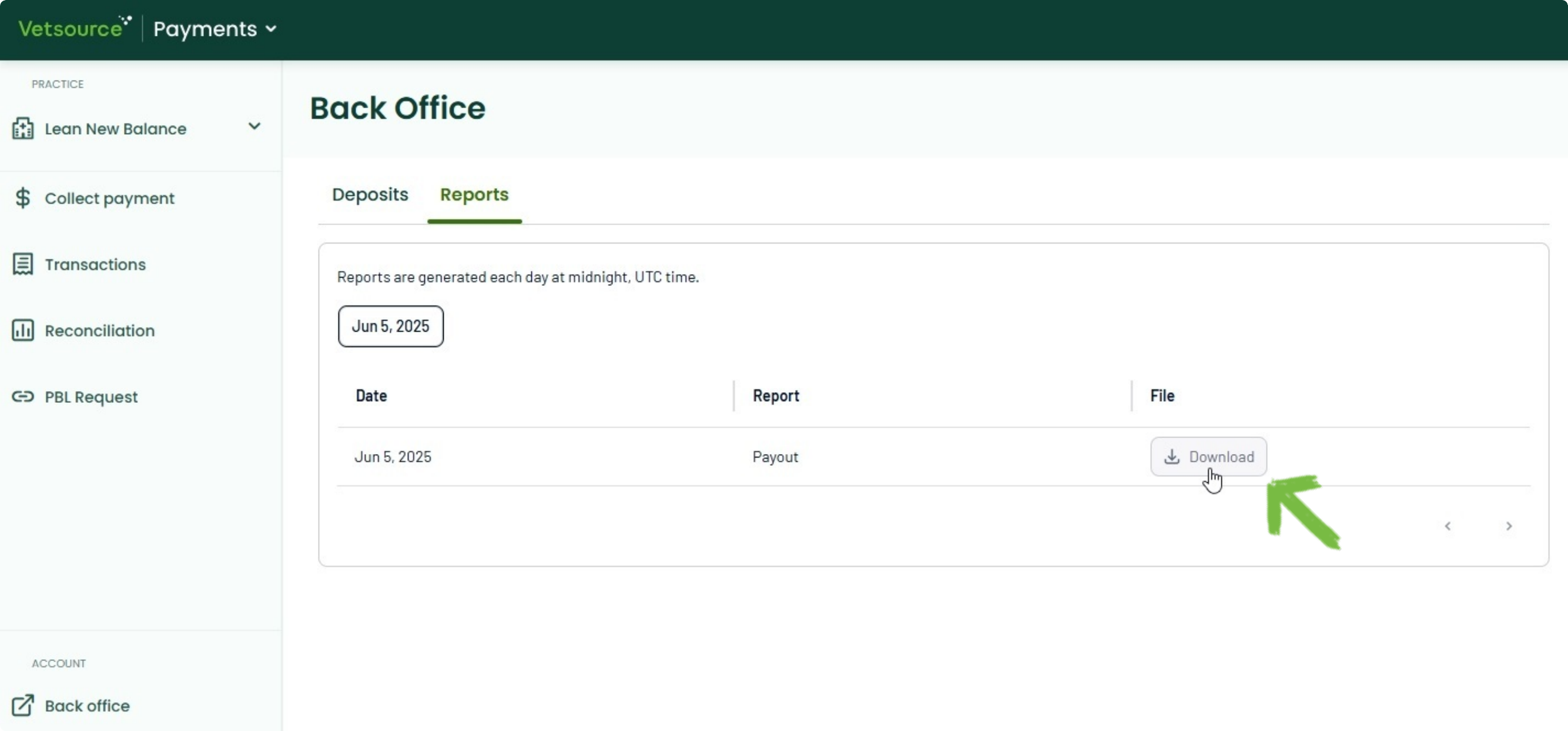

Reports

Download a CSV file of your deposit from the Reports tab for a breakdown of transactions and fees.

Security

For more information on how to secure your Back Office, see our article on Enhanced Security.

If you are interested in turning on Enhanced Security for your payments platform, reach out to Support.